There are well over 20 different agencies that collect consumer financial information. LexisNexis is one of the big ones, and all consumers should look at their report. This report has so much information, it can be overwhelming. We will cover how to read this report in a future article. This article will cover how to request your LexisNexis report in 2021.

Obtain Your LexisNexis Report in 2021!

One of the dark horse tactics I have used, quite successfully might I add, is to utilize the LexisNexis report to remove information from other consumer reports. This is how I generally advise removing tax liens, for example. Experian and Transunion both use LexisNexis to obtain public record information, so knowing what is on the report is important. In previous years, LexisNexis would only allow this by US Mail but the pandemic has changed the landscape in many ways. Now, LexisNexis will allow you to obtain your report with a simple web form. Here are the steps to request your free LexisNexis Report in 2021.

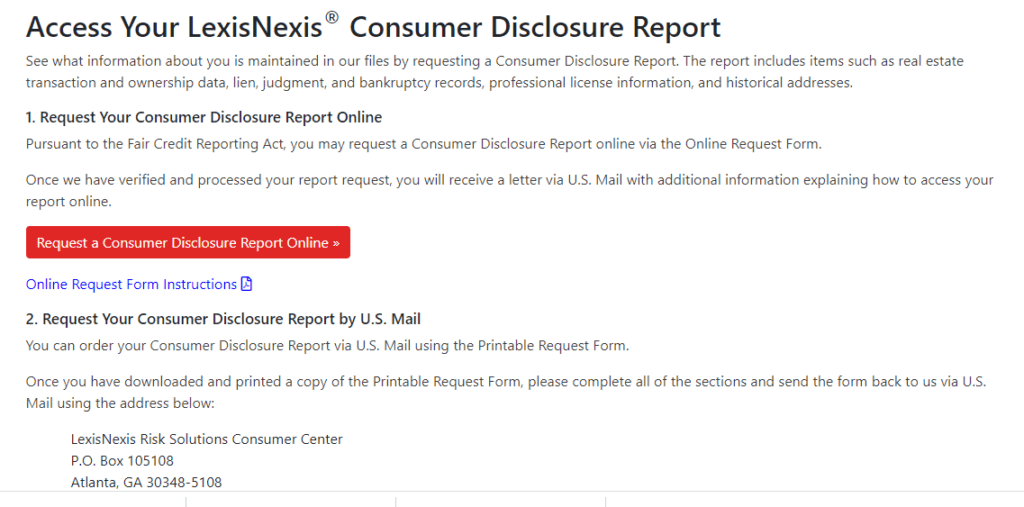

Navigate your browser to: https://consumer.risk.lexisnexis.com/consumer

Once you are at the website, make sure you click on the Request a Consumer Disclosure Report online. If you would rather do so by mail, you can still make a request by US Mail. From my perspective, the online form appears very secure although they do not use multifactor authentication, where as Transunion has moved to this technology.

All you need to do is fill out the form and submit the request. LexisNexis will send you the report within 2 weeks. The only caveat is once you submit, there is a responder indicating they may request more information by mail if needed, such as an ID. If you have trouble with the web form, I have successfully filled out the offline form and obtained my report in less than a month, so they are a responsive company in general.