When undertaking a credit rebuild or repairing credit, you must become a master at understanding your credit report. There are many moving parts to this document, and in this article we will cover exactly how to read your report.

Understanding Your Credit Report is NOT Easy!

Your credit report is an invaluable tool that will give you insight into your financial life. It contains information on what creditors think about the way in which you manage them, and it’s important to review this document at least once per year so you know what types of information they are placing in your file.

Understanding your credit report can be confusing, especially if you’re reading it for the first time. Here is a breakdown of the type of information contained in your report.

Personal Identification Information

Personal information including your name, address, and place of employment is used to identify you. Previous addresses and places of employment might also be included.

It’s not uncommon to have variations or misspellings of your name. Most credit reporting agencies leave these variations to maintain the link between your identity and the credit information. Having different variations of your name and old addresses won’t hurt your credit score as long as it’s actually your information. Make sure personal information is identifying you and not someone else. If you see addresses and names that you don’t recognize, try disputing this information first, and consider placing a Fraud Alert on your credit reports. Fraud alerts alone are worth taking the time in understanding your credit report.

Credit Summary

The credit summary section of your report is a concise collection of information about all the different accounts you have. It records how many are open, what their balances are at present time, as well as whether or not they’re current or delinquent.

- Real estate accounts: Mortgages, Home Equity Lines of Credit (HELOCs), Second Mortgages.

- Revolving accounts: Usually credit cards and lines of credit.

- Installment accounts: Auto Loans, Student Loans, Personal Loans, Secured Loans.

- Other accounts: American Express Charge Cards.

- Collection accounts: Collection Agency accounts reported.

Understanding Your Credit Report

The summary includes the information for each of the five types of accounts:

- Count: Total number of accounts you have in the given category.

- Balance: Total amount you owe on all accounts in the category.

- Payment: Total monthly payments you must make on all accounts in the category.

- Current: Number of accounts in the category that are properly paid.

- Delinquent: Number of accounts in the category for which payments are past due.

- Derogatory: Number of accounts in the category that negatively impact your credit rating.

- Unknown: Number of accounts in the category whose condition was not reported by the credit bureau.

This section also summarizes your open accounts, closed accounts, public records, and inquiries.

- Open/Closed Accounts: A total number of all accounts that are either open or closed.

- Public Records: A count of any public records in your name, and the total amount of money involved for all public records. Public records may include judgements against you in civil actions, state or federal tax liens, and/or bankruptcies.

- Inquiries: An inquiry appears when an organization such as a bank or retail store requests a copy of your credit report. This number reflects how many inquiries were made on your credit report within the last two years.

Account History

The account history section of your credit report contains the bulk of information. This includes each one of your many accounts and how you’ve handled it, so be sure to read closely! Each account will contain the several pieces of information.

- Creditor name of the institution reporting the information.

- Lender Industry of the Creditor

- Account number associated with the account. The account number may be scrambled or shortened for privacy purposes.

- Account Type, i.e. revolving account, education loan, auto loan, Other.

- Responsibility. This indicates whether you have individual, joint, or authorized user responsibility for the account.

- Monthly payment is the minimum amount you are required to pay on the account each month.

- Date opened. The month and year the account was established.

- Date reported is the last date the creditor updated the account information with the credit bureau.

- Balance. The amount owed on the account at the time data was reported. If you pay down credit cards, the balance will not update on your report, until your credit card issuer updates the data supplied to the Credit Reporting Agency.

- Credit limit or loan amount: The total available amount of credit on the account.

- High balance or high credit is the highest amount ever charged on the credit card. For installment loans, high credit is the original loan amount.

- Past due. Amount past due at the time the data was reported.

- Remarks are comments made by the creditor about your account.

- Payment status. Indicates the status of the account, i.e. current, past due, charge-off. Even if your account is current, it might contain information about previous delinquencies.

- Payment history. Indicates your monthly payment status since the time your account was established.

- Collection accounts may appear as part of the account history or in a separate section. Where it appears depends on the company providing your credit report.

The Lender Industry code used in your credit report can also impact your credit score. Certain types of accounts can be labeled as “Consumer Finance Accounts” Too many of these types of accounts can cause a score to drop.

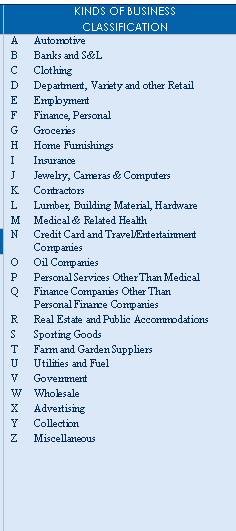

Here is a table with the industry codes for transunion, as reported by Freddie Mac:

Your 24 Month Payment History will be listed on the account. For each month of reporting, you will have a code. The codes are:

- OK – This account is paid on time and in full.

- NO – No data is available for a particular month. This is usually because either the account was not open or the creditor has not reported information to Experian in a given month.

- 30/60/90/120 – The number of days the account has been past due.

- KD – This stands for ‘Key Derogatory’ which can mean many things including: Claim, Term Default, Government Claim, Paid by Dealer, Bankruptcy Chapter 7, 11 or 12 Petitioned, or Discharged and Bankruptcy Chapter 7, 11, or 12 Reaffirmation of Debt Rescinded.

- RF – Property related to this account has been repossessed or foreclosed.

- PP – The creditor has established a revised payment plan with you.

- Make sure that the information in this section is accurate. Pay especially close detail to any information related to delinquency, collections or past due accounts either in the the account details area or in the 24 month payment history as all of these things negatively impact your credit report and credit score.

- Make sure all of your accounts in good standing are represented. Not all creditors report account data to all credit bureaus, so the Credit Reporting Bureau may not have access to information on all of your positive account information (of course, this means that they may not have access to negative account information as well). If you don’t see an account listed in your credit report that you believe to be in good standing then contact your creditor and ask them if they report your account information to the Credit Reporting Bureaus.

- Make sure you recognize all of the creditors and accounts listed in this section. Any unrecognized accounts could mean that your financial information may have been compromised and that identity thieves may have opened accounts in your name.

Different creditors report information in different cycles so it’s possible that the balance listed on your account might not be totally up-to-date. However, as long as you have verified this is an account with which you’re familiar and that its most recent update was accurate at some point recently past then no problem! If you don’t see this type of information update over time, it is a good idea to contact your creditor to see if there are any problems with your account.l

Correcting Errors: Credit reports often contain mistakes that lower the subject’s credit score. Perhaps the most common is the inclusion of someone else’s accounts which can also be known as a “merged file”. Sometimes, half of the borrowers accounts are missing, this is known as a “split file”. If this is happening to you, you will have to contact the bureau directly in order to fix the reporting error. Borrowers who find mistakes must take the initiative to get them fixed, which means writing to the Credit Reporting Bureau reporting the erroneous information and detailing the particulars of the error.

Under the Fair Credit Reporting Act (FCRA), a Credit Reporting Bureau has 30 days from the day it receives your dispute to complete its investigation and report back to you, the borrower. The report must indicate that the error was corrected, or there was no error, or the credit grantor did not respond, in which case the disputed item is dropped from the report. For more information about correcting errors, feel free to visit the Rebuilding Forum.

Because fixing errors takes time, it is a good idea for borrowers to check their credit well in advance of entering the credit market or applying for an important loan such as a mortgage loan or auto loan. This make understanding your credit report key!

Understanding Your Credit Report on Public Records

Public records include information like bankruptcies, judgments, tax liens, state and country court records, and, in some states, overdue child support. Depending on the type of account, a public record can remain on your credit report between 7-10 years. Only severe financial blunders appear in this section, not criminal arrests or convictions. Because public records can severely damage your credit, it’s best to keep this section clear.

If a prior judgment has been DISMISSED, or VACATED, you can have this Public Record account removed using the Dispute process. A SATISFIED Judgment can remain on your report and causes the same FICO effect as an un-paid judgment.

For each public record, some or all of the following information may appear—

- Type: The type of record, be it a Tax Lien, Legal Item, Bankruptcy, Wage Item, Judgment, etc.

- Status: Current status of the record.

- Date Filed/Reported: Date when the record was initially filed or created.

- How Filed: The role that you play in the record, usually the record is either filed

- Individually or Jointly.

- Reference #: Identifying number for the record.

- Closing/Released Date: Date when the record was closed or the judgment awarded.

- Court: The court or legal agency that has jurisdiction over the record.

- Amount: Dollar amount of the lien or judgment.

- Remarks: If there are any remarks by you or the court included in the public record information, these remarks will appear here.

If the Public Record is a Bankruptcy, three other fields will be visible—

- Liability: The amount the court found you to be legally responsible to repay.

- Exempt Amount: A dollar amount claimed against you, but an amount in which the court has decided you are not legally responsible.

- Asset Amount: The dollar amount of total personal assets used in the court’s decision. The Asset Amount can include items of value that can be used to pay debts.

Inquiry Information

The INQUIRY INFORMATION section lists details about each inquiry that has been made into your credit history. Details include the name of the creditor or potential creditor who made the inquiry and the date when the inquiry was made.

An inquiry appears when an organization such as a bank or retail store requests a copy of your credit report. These requests can only be made if you have a credit granting relationship or are applying for credit with the organization. The requestor’s name will appear on your credit report, allowing you to monitor who accessed your credit report.

Please Note: An excessive number of inquiries may adversely affect your creditworthiness. However, inquiries you personally have made via AnnualCreditReport.com or MyFico.com are considered to be “soft inquiries” that will not negatively impact your credit standing.